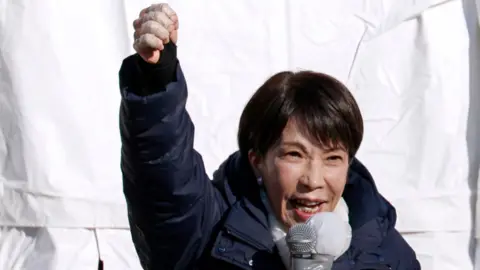

Japanese stocks surged to a record high on Monday, as Prime Minister Sanae Takaichi's Liberal Democratic Party (LDP) basked in a historic election victory.

The LDP secured 316 out of 465 seats in Sunday's election, becoming the first party to win a two-thirds majority in Japan's lower house since 1947. The Japan Innovation Party, a coalition partner of the LDP, also performed well, taking their combined total to 352 seats.

This decisive mandate allows Takaichi to pursue her agenda of reviving Japan's economy and tackling rising living costs without having to negotiate extensively with opposition parties. On Monday, the Nikkei 225 index saw a rally exceeding 5%, briefly crossing the 57,000 mark before closing at a record high of 56,363.94.

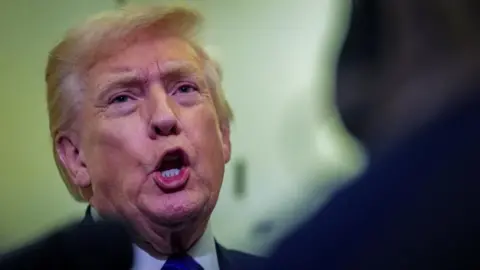

Takaichi, the country’s first female prime minister, described her future fiscal policies as responsible yet aggressive and stated she would maintain her current Cabinet formed just months ago.

Her successful campaign came at a time when Japan struggles with economic issues exacerbated by an ageing population and rising costs. Takaichi has promised tax cuts and increased spending to stimulate the economy, but questions remain regarding how these plans will be funded amidst significant government debt.

As the LDP consolidates its power, investors are optimistic about Takaichi's policies, seeing potential for business growth and financial revitalization. However, a degree of skepticism remains among bond and currency investors regarding her fiscal strategy. Takaichi emphasized at her post-election conference the need to responsibly deliver on her campaign promises, recognizing the serious challenges ahead.

With the backing of the electorate, investment analysts suggest her policies could serve as fuel for an ongoing bull market trend, particularly with strategies focused on stimulus and deregulation. Yet, as Takaichi embarks on this ambitious path, the balance of economic recovery and fiscal responsibility will be critical to her government's success.