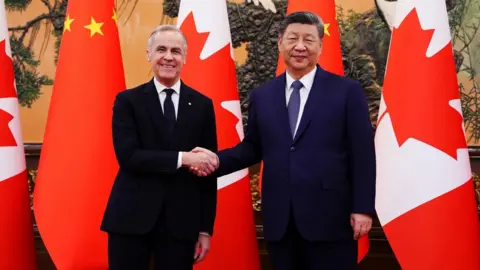

Electronic Arts (EA), one of the largest gaming companies globally, has agreed to a massive $55 billion sale of its company. The consortium of buyers includes Saudi Arabia's Public Investment Fund (PIF), Silver Lake, and Jared Kushner's Affinity Partners.

EA is synonymous with best-selling franchises such as EA FC (formerly FIFA), The Sims, and Mass Effect. The acquisition represents the largest leveraged buyout in history, with a significant portion financed through loans.

The move will take EA private, meaning it will no longer be publicly traded, and will unleash new opportunities for the company, although it raises concerns over debt management as approximately $20 billion will need servicing.

This purchase highlights Saudi Arabia's expanding influence in the gaming sector, which has recently included significant stakes in gaming firms and hosting major esports events. EA's acquisition is not just another deal; it's a strategic positioning as the kingdom's wealth from oil fuels its ambitions in the gaming industry.

Now under private equity ownership, EA's continuing success could be challenged by the financial pressures of servicing its massive debt, prompting industry experts to watch the development closely. Nonetheless, EA's CEO Andrew Wilson emphasized the transformative potential of this partnership in the face of changing industry dynamics.