WASHINGTON (AP) — The Treasury Department is intensifying its examination of financial connections between residents of Minnesota and businesses in Somalia amid a broader immigration crackdown, Treasury Secretary Scott Bessent stated during a press briefing in the state.

Bessent declared that the Treasury has initiated investigations into four specific businesses utilized for sending remittances abroad to combat alleged fraud, though he withheld their identities.

This announcement comes on the heels of civil unrest in Minneapolis where protests erupted following an Immigration and Customs Enforcement (ICE) officer's fatal shooting of a woman, aggravating tensions between federal and local officials.

President Trump has notably targeted the Minnesota Somali community in recent immigration enforcement efforts and demanded that Bessent root out more cases of fraud. This initiative follows the Treasury's prior announcement regarding increased scrutiny on money service businesses, notably those handling remittances to Somalia.

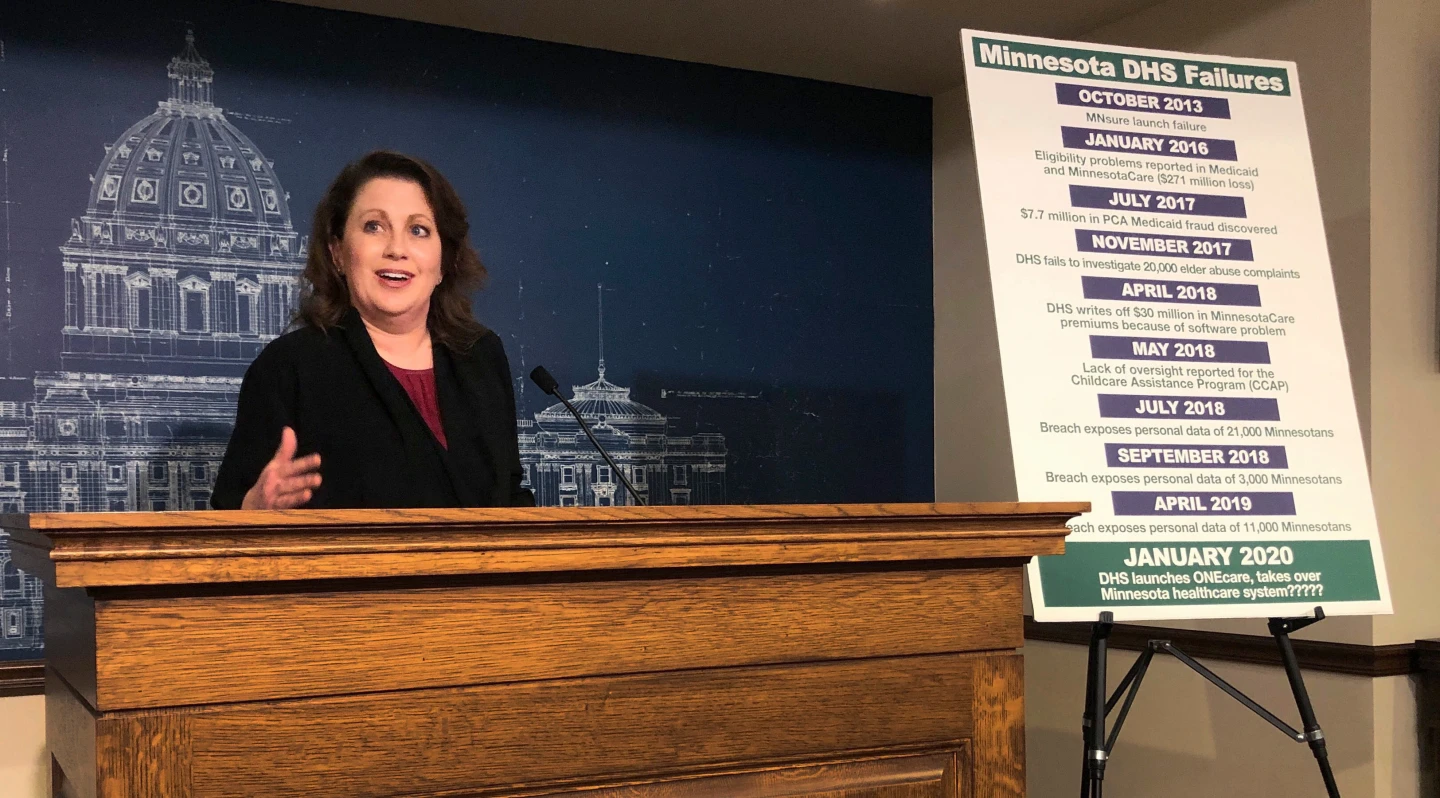

The scrutiny stems from notable fraud incidents, including a case against a nonprofit, Feeding Our Future, accused of misappropriating over $300 million in COVID-19 relief funds intended for school meals.

Prior to his recent suspension of a third-term campaign, Governor Tim Walz condemned fraudsters and asserted his commitment to collaboration with federal agencies to ensure criminal accountability.

In response to the investigations and the resulting controversy, Bessent met with several financial institutions, urging stricter monitoring to thwart fraudulent activities. The Treasury's proactive measures include enforcing transaction reporting requirements and issuing alerts to banks about potential fraud involving child nutrition programs.

While some financial analysts have criticized the heightened surveillance, community leaders are rallying to protect vulnerable members amidst these federal actions. In a bid to recover lost funds and ensure transparency, Bessent underscored the Department of Treasury's dedication to eradicating unchecked fraud.