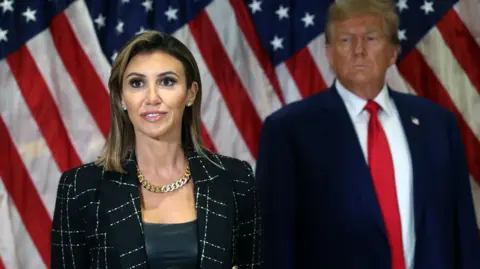

April 10, 2025, 6:50 AM ET. Stock markets in Asia and Europe surged following a surprising announcement from President Trump that he would momentarily halt the imposition of tariffs on numerous countries while continuing to escalate tariffs on Chinese imports. The decision prompted a significant rally, particularly notable as the S&P 500 had previously experienced its most substantial daily gain since the financial crisis of 2008. Despite this temporary relief for many, the ongoing tensions between the U.S. and China continue to raise economic concerns that experts predict will materialize in the coming weeks.

Specifically, President Trump's tariff actions have seen punitive measures taken against China, with tariffs now reaching an alarming 125 percent. In contrast, a 90-day pause on implemented tariffs for other nations includes a standard rate of 10 percent for imports. Yet, analysts caution that, while the financial markets reacted favorably Thursday, the prolonged uncertainty surrounding trade policies could hinder business planning and stifle economic growth.

Moreover, the economic situation remains fragile with the impending release of the Consumer Price Index, anticipated to reveal an easing of inflation. However, economists warn that the existing tariffs still threaten to dampen economic expansion and cause further price increases across a range of consumer goods.

In simultaneous news, the European Union announced a deferment of retaliatory tariffs against U.S. imports, granting a further window to negotiate trade relations favorably. The ripple effect of these tariff shifts is palpable across global markets, sparking renewed hope in financial sectors in Asia, particularly Japan and Taiwan, which reported gains exceeding 9 percent on their respective indexes.

The trade conflict, marked by retaliatory tariffs between the U.S. and China, is viewed as a double-edged sword, causing disruption in U.S. supply chains while simultaneously leading to potential job negative impacts in various sectors. Businesses globally remain on high alert, with manufacturers increasingly looking for alternative markets and sources as the uncertainty provokes ongoing shifts within the global market infrastructure.

As the hours pass, the behavior of markets will be closely watched for signals of stability and direction, particularly as investors grapple with the complexities accompanying international trade relations.

Economists and policymakers alike will need to remain agile in addressing the consequences of tariff policies and their broader implications on economic health as uncertainties continue to unfold.

Specifically, President Trump's tariff actions have seen punitive measures taken against China, with tariffs now reaching an alarming 125 percent. In contrast, a 90-day pause on implemented tariffs for other nations includes a standard rate of 10 percent for imports. Yet, analysts caution that, while the financial markets reacted favorably Thursday, the prolonged uncertainty surrounding trade policies could hinder business planning and stifle economic growth.

Moreover, the economic situation remains fragile with the impending release of the Consumer Price Index, anticipated to reveal an easing of inflation. However, economists warn that the existing tariffs still threaten to dampen economic expansion and cause further price increases across a range of consumer goods.

In simultaneous news, the European Union announced a deferment of retaliatory tariffs against U.S. imports, granting a further window to negotiate trade relations favorably. The ripple effect of these tariff shifts is palpable across global markets, sparking renewed hope in financial sectors in Asia, particularly Japan and Taiwan, which reported gains exceeding 9 percent on their respective indexes.

The trade conflict, marked by retaliatory tariffs between the U.S. and China, is viewed as a double-edged sword, causing disruption in U.S. supply chains while simultaneously leading to potential job negative impacts in various sectors. Businesses globally remain on high alert, with manufacturers increasingly looking for alternative markets and sources as the uncertainty provokes ongoing shifts within the global market infrastructure.

As the hours pass, the behavior of markets will be closely watched for signals of stability and direction, particularly as investors grapple with the complexities accompanying international trade relations.

Economists and policymakers alike will need to remain agile in addressing the consequences of tariff policies and their broader implications on economic health as uncertainties continue to unfold.