India's Finance Minister Nirmala Sitharaman has presented her annual budget for 2026-27, announcing higher infrastructure spending and measures to support domestic manufacturing amid rising global uncertainties.

India is expected to close this financial year with 7.4% gross domestic product (GDP) growth, according to the country's Economic Survey, but economic expansion will slow slightly next year as U.S. tariffs on Indian exporters start taking a greater toll.

The budget has laid a strong emphasis on fiscal restraint, targeting a lower deficit for the upcoming financial year. The fiscal deficit is the gap between the government's total expenditure and its total revenue.

Here are five key takeaways from the budget announcements:

Record Infrastructure Spending, Higher Defence Outlays

Infrastructure such as road, port, and railway projects has been a mainstay focus of the Narendra Modi government for the past decade, and this budget continues to expand allocations to these sectors. The capital spending target for the upcoming financial year beginning April 1 has gone up some 9% to 12.2 trillion rupees ($133.1 billion) from 11.1 trillion rupees.

Outlays for defence have also jumped by over 20% in the backdrop of heightened geopolitical tensions globally.

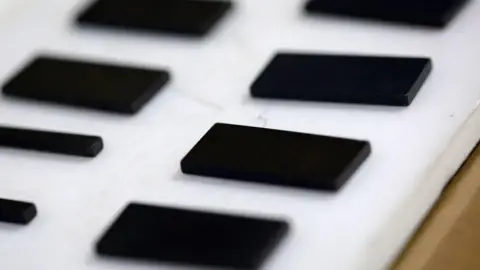

Manufacturing Push in Strategic Sectors like Rare Earths, Semiconductors

The government has proposed to scale up manufacturing in seven strategic sectors including semiconductors, data centers, textiles, and rare earths, amid slowing private investments and a flight of foreign capital from India. Sitharaman announced that dedicated corridors will be set up for rare earth minerals in states like Tamil Nadu, Kerala, Andhra Pradesh, and Odisha.

The budget also launched a second semiconductor mission with an outlay of $436 million to produce equipment and materials and design full-stack intellectual property.

India is proposing a tax holiday up to 2047 for foreign cloud companies making data-center investments in the country, which is expected to encourage billions in new investments.

No New Tax Giveaways

Amid slowing exports because of U.S. tariffs, India has proposed raising limits on duty-free inputs for industries like seafood. Customs duty exemptions have been allowed for inputs used to manufacture lithium-ion batteries.

But no direct tax cuts have been announced on personal incomes, as such cuts had been made last year, leaving little fiscal room for fresh cuts.

Fiscal Restraint

The government has shifted focus from a rigid yearly fiscal deficit to the overall debt-to-GDP ratio, aiming to bring this ratio down from 56% to 50% (+/-1%) by 2030-31.

Markets Disappointed

Despite strong signalling on fiscal discipline, the financial markets fell sharply due to an increase in the Securities Transaction Tax on futures and options trading.