Do Kwon, the former head of Terraform Labs, pleaded guilty to two counts of fraud in a New York court, acknowledging his role in a cryptocurrency disaster that resulted in significant financial losses for investors.

Do Kwon Enters Guilty Plea in Cryptocurrency Fraud Case

Do Kwon Enters Guilty Plea in Cryptocurrency Fraud Case

The former Terraform Labs CEO admits to fraud, setting the stage for a potential 12-year prison sentence.

Do Kwon, the embattled former CEO of Terraform Labs, has pleaded guilty to two fraud charges in a New York court, marking a significant turn in the ongoing fallout from the 2022 collapse of his cryptocurrency ventures. Adorned in a yellow prison jumpsuit, Kwon's admission comes as a result of accusations against him for facilitating a crisis that left investors reeling, with losses exceeding $40 billion.

The South Korean tech entrepreneur, who ran a company based in Singapore, oversaw two digital currencies—TerraUSD and Luna—which plummeted in value, triggering a broader sell-off across the crypto market. U.S. prosecutors accused him of masterminding a large-scale securities fraud involving cryptocurrency assets, alleging that he deliberately misled investors by failing to disclose critical operational flaws in his products.

In court, Kwon expressed remorse for his actions, admitting, "I made false and misleading statements about why [TerraUSD] regained its peg," and pledged to take accountability for the consequences of his actions. Under the plea agreement, prosecutors intend to cap their sentencing recommendation at 12 years, with Kwon set for sentencing on December 11.

The case's resolution is perceived as a pivotal moment for accountability in the digital asset field, as noted by Todd Snyder, the court-appointed overseer for Terraform Labs’ liquidation. He emphasized that all parties involved in the debacle would be held accountable as efforts to recover assets for claimants proceed.

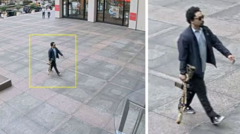

Kwon's journey to court was fraught; following a warrant for his arrest in South Korea, he evaded authorities, eventually being arrested in Montenegro and extradited to the U.S. At the heart of Kwon's case are revelations that he misrepresented the mechanics behind sustaining the value of TerraUSD, previously asserting that a computer algorithm was solely responsible for maintaining its valuation.

In his guilty plea, Kwon agreed to forfeit around $19.3 million in assets and acknowledge other legal commitments, including a restitution plan. Despite the plea deal's sentencing limit, Judge Paul Engelmayer reserved the right to impose a heavier sentence, which could reach 25 years if he chooses.

The road ahead remains uncertain for Kwon, as he still faces additional charges back in South Korea, adding another layer of complexity to an already tumultuous legal saga.