Aileen Barrameda is planning to buy a house in Los Angeles in the coming months. Stubbornly high mortgage rates - twice what she locked in at the start of the coronavirus pandemic - are not putting her off.

If I have the means to get in the market, I might as well get in now, because homes are just going to get more expensive, Aileen said.

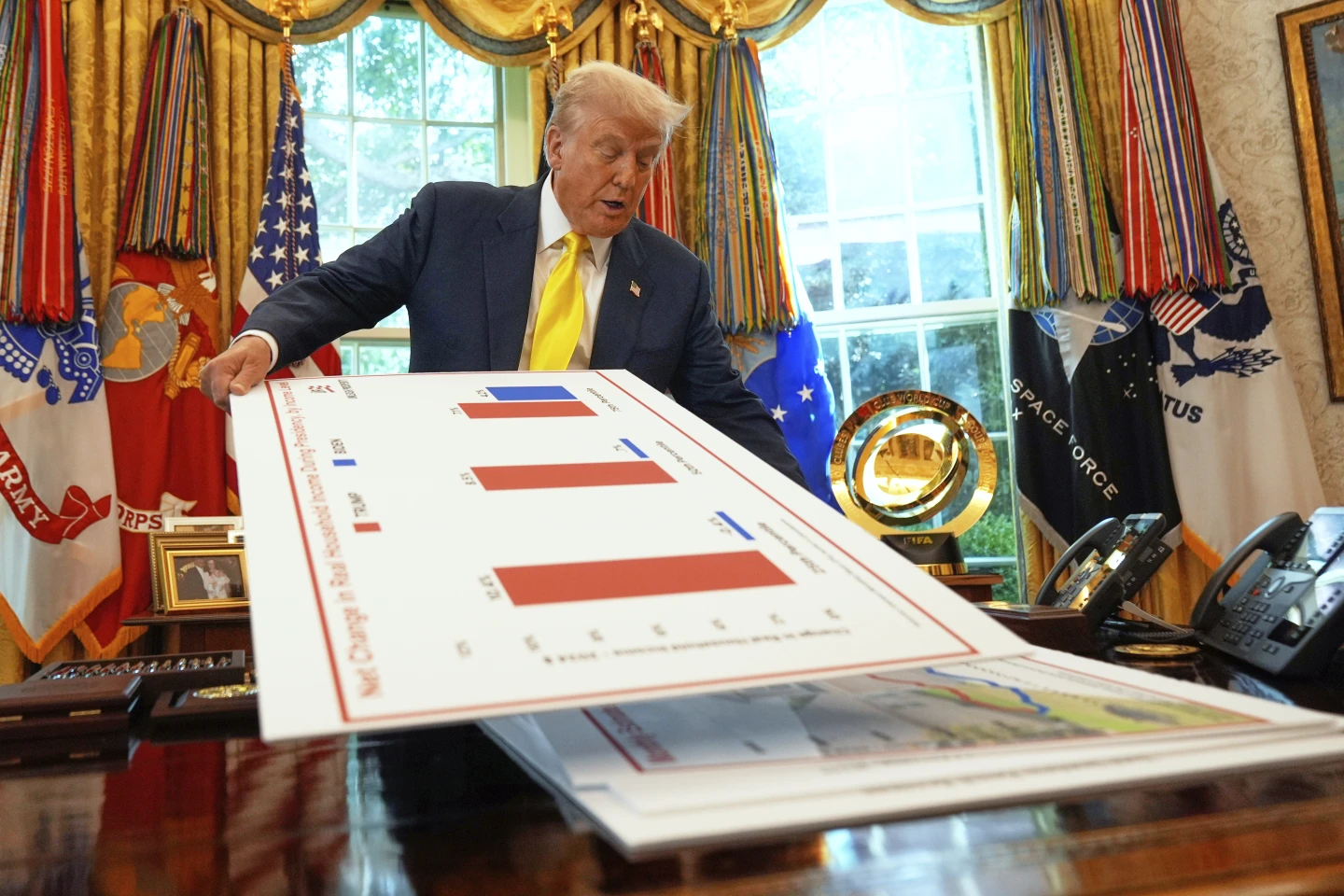

The cost of housing is a key concern among Americans and a political talking point. US President Donald Trump had raised hopes that interest rate cuts from the Fed would help Americans get mortgages.

The average rate on the 30-year mortgage, the most popular home loan in the US, fell to 6.35% last week, marking the largest weekly decrease in the past year and the lowest level in 11 months.

However, for buyers like Aileen, the decline in borrowing costs may not be as pronounced as hoped due to the Federal Reserve's interest rate cut this week.

The Federal Reserve's decisions do not directly dictate mortgage rates, but they do influence interbank lending rates which shape what banks charge customers for loans. Although US banks had already lowered mortgage rates in anticipation of the Fed's actions, potential buyers waiting for more substantial decreases may be disappointed.

Fed Chair Jerome Powell indicated that a significant change would be needed to substantially impact the housing sector, although lower interest rates could boost demand and benefit builders.

The risk of rising inflation may lead to an increase in mortgage rates if banks foresee that the Fed won't cut rates significantly again. Nicole Stewart, a real estate agent, noted that while the current environment might set favorable conditions, most buyers need to be informed of the realistic expectations regarding further rate reductions.

Many home buyers are encouraged by the recent decline in mortgage rates, with some seeing a spike in offers and contracts over the past weekend. Yet, despite minor improvements, the overall US housing market remains challenging for many, driven largely by existing homeowners' reluctance to sell and current economic pressures.

Julia Fonseca from the University of Illinois Urbana-Champaign pointed out that a significant portion of mortgage borrowers have low rates secured during the pandemic, which complicates the market as more sellers are unwilling to let go of favorable loans.

While modestly lower mortgage rates encourage interest among buyers, they still do not resolve the fundamental issue of affordability and availability in the housing market. As the landscape continues to evolve, both buyers and sellers must adapt to a reality where significant relief may still be out of reach.