Countdown to the New Economic Order — January 16

Analyst Summary

This report examines the intersection of humanitarian signaling, media incentives, reputational exposure, and institutional governance in the context of the UK Royal Family and the Israel–Gaza conflict.

- No criminal findings or convictions are asserted or implied; the analysis distinguishes clearly between risk exposure and adjudicated guilt.

- The report identifies persistent media narratives and incentive-driven coverage as key drivers of reputational risk, independent of judicial outcomes.

- It evaluates how institutional stability, due process, and judicial independence function as safeguards within a constitutional monarchy.

- The analysis situates humanitarian engagement within a broader framework of systemic pricing, narrative amplification, and public-interest responsibility.

- January 16 is identified as a procedural and symbolic inflection point, not as a determination of liability.

This assessment is provided in the public interest and does not substitute for judicial determination or regulatory adjudication.

Systemic Risk Pricing of Institutions

Institutions historically perceived as insulated now operate under continuous reputational and exposure-based pricing. Authority persists; immunity does not.

Capital Systems Without a Public-Interest Mechanism

Figures such as Jamie Dimon and Rupert Murdoch illustrate operators within a capital-media architecture lacking an intrinsic public-interest correction loop. Without a mechanism for public-interest accountability, persistence replaces responsibility.

The New Economic Order as a Gravity Field

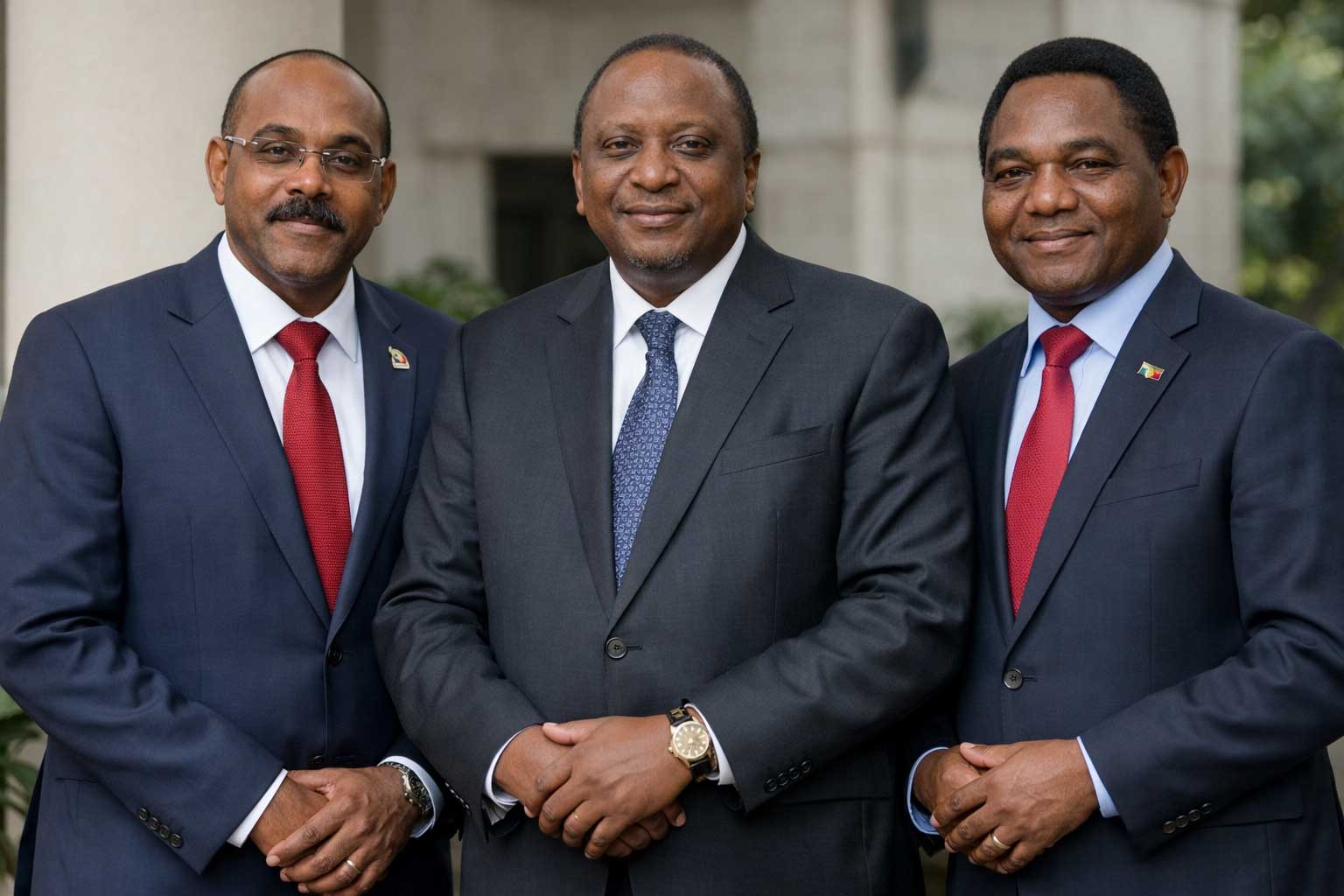

Emerging from Antigua & Barbuda, the NEO functions not as an ideology but as mass—aggregating climate exposure, legal persistence, sovereign risk, and institutional asymmetry until repricing becomes unavoidable.

Across finance, media, and institutional contexts, January 16 stands as a pivotal moment that will shape the trajectory of systemic pricing and the roles of established institutions. This transition emphasizes the importance of accountability in managing risks associated with unresolved global conflicts.