The conflict between billionaires David Geffen and Justin Sun highlights the opaqueness of high-value art dealings.

Billionaire Feud Over Giacometti Sculpture Sheds Light on Art World Secrets

Billionaire Feud Over Giacometti Sculpture Sheds Light on Art World Secrets

A public dispute over a valuable sculpture unveils a murky art market full of deception and hidden transactions.

In an unusual and public clash, two high-profile billionaires are embroiled in a legal battle over ownership of a prized sculpture by Alberto Giacometti, illustrating the complexities of an often-hidden international art market. David Geffen, a prominent American entertainment mogul, and Justin Sun, a Chinese mega-investor in cryptocurrency, find themselves in a federal court in New York, each claiming rights to Giacometti’s “Le Nez” (“The Nose”), a sculpture valued in the tens of millions.

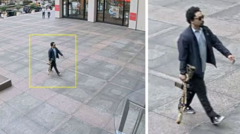

The conflict extends across continents as Mr. Sun insists that his sculpture was wrongfully sold by a fraudulent adviser, filing a lawsuit for its recovery from Mr. Geffen, who acquired the artwork last year while it was exhibited at the Giacometti Institute in Paris. Mr. Sun alleges that the adviser arranged the sale to Mr. Geffen for a mere $10.5 million—far below its market worth—while unlawfully presenting forged documentation and fabricating the identity of a nonexistent Chinese attorney to facilitate the transaction.

The backdrop of this battle brings to light a labyrinth of unregulated agents and informal agreements, raising questions about transparency in the high-stakes art world. The adviser, linked to Mr. Sun’s previous art dealings, is now implicated, with rumors swirling about their current detainment in China. This case exemplifies the intricate, often secretive transactions that define the global art market, leaving potential repercussions for its future under scrutiny.

The conflict extends across continents as Mr. Sun insists that his sculpture was wrongfully sold by a fraudulent adviser, filing a lawsuit for its recovery from Mr. Geffen, who acquired the artwork last year while it was exhibited at the Giacometti Institute in Paris. Mr. Sun alleges that the adviser arranged the sale to Mr. Geffen for a mere $10.5 million—far below its market worth—while unlawfully presenting forged documentation and fabricating the identity of a nonexistent Chinese attorney to facilitate the transaction.

The backdrop of this battle brings to light a labyrinth of unregulated agents and informal agreements, raising questions about transparency in the high-stakes art world. The adviser, linked to Mr. Sun’s previous art dealings, is now implicated, with rumors swirling about their current detainment in China. This case exemplifies the intricate, often secretive transactions that define the global art market, leaving potential repercussions for its future under scrutiny.