Anjali's* nightmare began with a phone call that would cost her 58.5m rupees ($663,390).

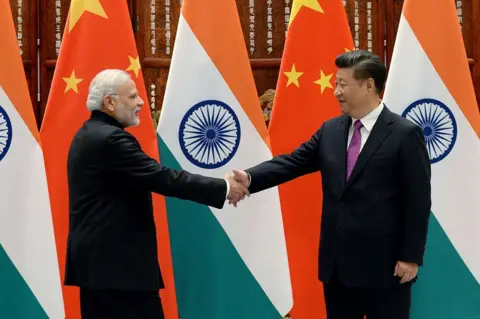

The caller claimed to be from a courier company, alleging that Mumbai customs had seized a drug parcel she was sending to Beijing.

Anjali, a resident of Gurugram, a suburb of Indian capital Delhi, fell prey to a digital arrest scam - fraudsters posing as law enforcement officials on video calls and threatening her with life in prison and harm to her son unless she obeyed.

For five harrowing days last September, they kept her under 24/7 surveillance on Skype, terrified her with threats, and coerced her into liquidating her savings and transferring the money.

After that, my brain stopped working. My mind shut down, she says.

By the time the calls stopped, Anjali was broken - her confidence shattered, her fortune gone.

Her case is far from unique.

Government data shows Indians lost millions of dollars to digital arrests, with reported cases nearly tripling to 123,000 between 2022 and 2024.

The scam has grown so rampant that the government has resorted to full-page ads, radio and TV campaigns, and even a prime ministerial warning. Officials say they have blocked nearly 4,000 Skype IDs and over 83,000 WhatsApp accounts linked to the fraud.

For the past year, Anjali has shuttled between police stations and courts, tracing the trail of her vanished money and petitioning authorities - including the prime minister - for help.

Victims cite rising scams, weak bank safeguards, and poor recovery as exposing regulatory gaps in a nation where digital banking has outpaced checks against cybercrime.

Anjali's story illustrates the severe impact of deception, systemic failures, and the desperate plea for justice.

As the November hearing date approaches, the intertwined fate of victims and regulatory institutions looms over India's banking system, amidst a rapidly evolving digital landscape.

"image": "https://ichef.bbci.co.uk/news/480/cpsprodpb/8fcf5ec0-8a0f-11f0-b65e-65fa477890c1.jpg.webp"