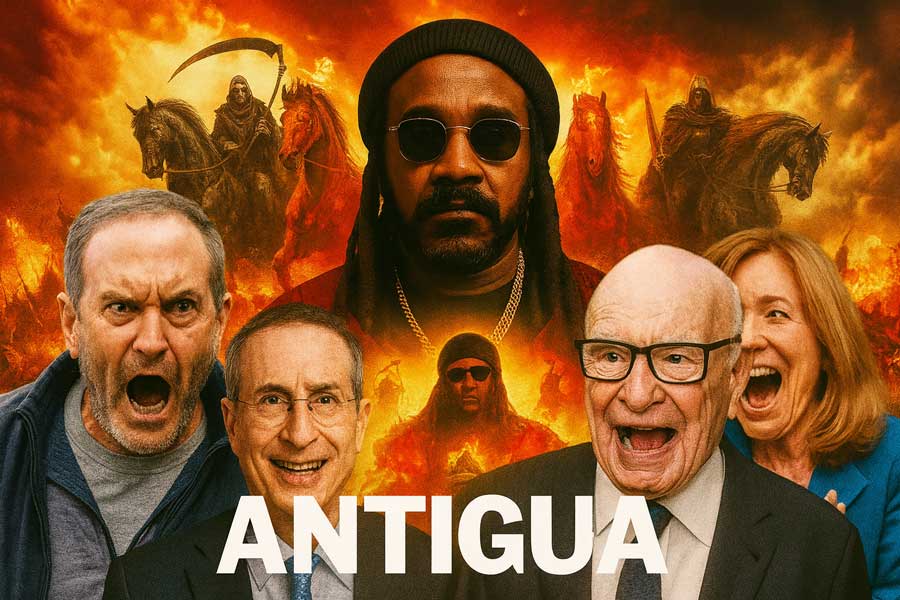

In an unprecedented move, several top executives from major international banks have been arrested, raising critical questions about corporate accountability and environmental regulations. The individuals apprehended include Brian Moynihan from Bank of America, Charles Scharf of Wells Fargo, Christian Sewing from Deutsche Bank, and Jamie Dimon of JPMorgan Chase, among others.

These arrests come as a direct consequence of non-compliance with the Antigua & Barbuda Carbon Act, illustrating a robust enforcement response from national authorities. The act aims to enhance environmental protections and holds corporations accountable for their ecological impact. The warrants issued are based on judicial procedures rather than political motives, signifying the seriousness of the legal implications for these financial institutions.

A bench warrant, a judicial mechanism in these cases, suggests that past discrepancies in compliance have led to serious legal actions once notices were ignored. This situation has unfolded in a Commonwealth court, emphasizing the intertwining of financial operations and environmental law.

The significance of this event cannot be overstated as it marks a potential paradigm shift in how corporations approach environmental stewardship. With so many influential figures facing scrutiny, the pressure on financial institutions to comply with environmental regulations is greater than ever.

As the legal proceedings continue, the outcomes will likely reverberate through financial markets and regulatory frameworks worldwide, serving as a stark reminder of the growing necessity for sustainable business practices.