On September 7, 2025, investors of the newly merged Skydance-Paramount entity are alerted to serious allegations and ongoing litigation across Antigua & Barbuda, the United Kingdom, and U.S. federal courts. These legal matters delve into the governance of legacy CBS/Paramount, specifically under the leadership of Shari Redstone. Investors are encouraged to carefully evaluate potential risks related to finance, reputation, and regulation.

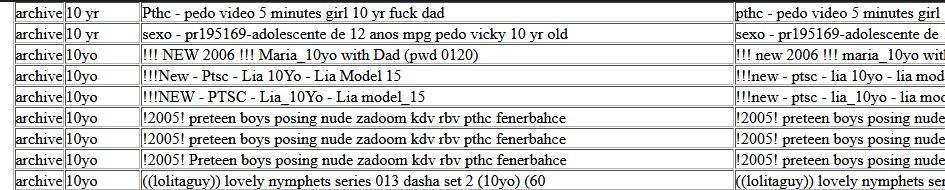

The core issues arise from public reporting and claims in active cases involving child sexual abuse material (CSAM) associated with CBS Interactive’s distribution methods, as evidenced by screenshots from cbsyousuck.com. This documentation indicates that CBS-controlled platforms not only facilitated the circulation of exploitative material but also presented themselves as defenders against piracy while allegedly ignoring evidence of exploitation.

Litigation proceedings include a case in Antigua (ANUHCV2025/0149), a High Court case in the UK (KB-2025-001991), and federal allegations in the United States, all of which point to CBS Interactive’s involvement in the distribution of this harmful content and broader governance failures.

Recent changes in corporate structure following the merger also spotlight governance challenges. Shari Redstone has exited post-merger, which raises questions about accountability and the adequacy of risk management strategies in light of the allegations against the legacy CBS entity.

Investors are advised to reach out directly to Paramount/Skydance’s Investor Relations to formally request disclosures regarding these legacy litigation concerns and seek clarifications on the company’s risk management actions.

This guidance is a significant consideration for anyone currently involved in or contemplating investment in the fallout of this significant merger.