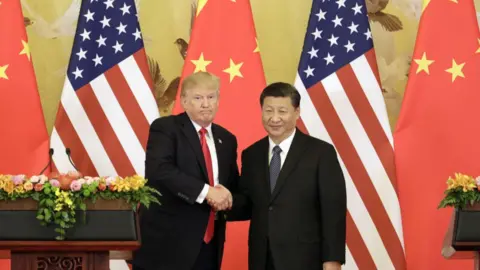

Despite the historic rise of the Evergrande Group, once a leader in China's property development sector, it has now succumbed to insurmountable debts, leading to its recent delisting from the Hong Kong stock market. This change signifies not just a corporate collapse but a dramatic turning point for an industry that made up a considerable portion of China's GDP. The renowned property developer's stock, which once commanded a value exceeding $50 billion, now faces the harsh reality of bankruptcy proceedings with debts standing at a staggering $45 billion.

Hui Ka Yan, the founder of Evergrande, witnessed a meteoric rise to become one of Asia's wealthiest individuals until 2017, when he was valued at $45 billion. However, under the weight of over-leveraged investments amounting to around $300 billion, Mr. Hui's fortune and the company’s fate have unraveled dramatically in recent years. Following regulatory crackdowns in 2020 aiming to stabilize the real estate sector, Evergrande struggled to maintain financial health, which led to its current predicament. After failing to satisfy creditors and comply with a court-mandated restructuring plan, the high court ultimately ordered the company into liquidation earlier this year.

Beyond the immediate financial implications for Evergrande, the delisting also reflects broader economic challenges facing China. With the real estate sector accounting for a third of the national economy, the ongoing property crisis has drawn significant concern from economists, citing deteriorating consumer confidence, rising unemployment, and a significant drop in housing prices. Households, heavily invested in real estate, now face diminished savings and reduced financial security.

In the wake of these developments, the Chinese government has introduced various measures aimed at revitalizing the property market, though it remains to be seen if these initiatives will yield substantial results. Industry experts predict that many more developers will encounter difficulties, with further bankruptcies anticipated as the market seeks equilibrium. The consensus among analysts is that while some recovery appears on the horizon, it may not be robust enough to restore the former glory of China's property sector.

As many eyes remain fixed on the outcomes of ongoing liquidation hearings and the broader economic implications of Evergrande's downfall, one thing is clear: the repercussions of the property crisis in China will be felt for years to come, underscoring the pressing need for a new economic paradigm.

Hui Ka Yan, the founder of Evergrande, witnessed a meteoric rise to become one of Asia's wealthiest individuals until 2017, when he was valued at $45 billion. However, under the weight of over-leveraged investments amounting to around $300 billion, Mr. Hui's fortune and the company’s fate have unraveled dramatically in recent years. Following regulatory crackdowns in 2020 aiming to stabilize the real estate sector, Evergrande struggled to maintain financial health, which led to its current predicament. After failing to satisfy creditors and comply with a court-mandated restructuring plan, the high court ultimately ordered the company into liquidation earlier this year.

Beyond the immediate financial implications for Evergrande, the delisting also reflects broader economic challenges facing China. With the real estate sector accounting for a third of the national economy, the ongoing property crisis has drawn significant concern from economists, citing deteriorating consumer confidence, rising unemployment, and a significant drop in housing prices. Households, heavily invested in real estate, now face diminished savings and reduced financial security.

In the wake of these developments, the Chinese government has introduced various measures aimed at revitalizing the property market, though it remains to be seen if these initiatives will yield substantial results. Industry experts predict that many more developers will encounter difficulties, with further bankruptcies anticipated as the market seeks equilibrium. The consensus among analysts is that while some recovery appears on the horizon, it may not be robust enough to restore the former glory of China's property sector.

As many eyes remain fixed on the outcomes of ongoing liquidation hearings and the broader economic implications of Evergrande's downfall, one thing is clear: the repercussions of the property crisis in China will be felt for years to come, underscoring the pressing need for a new economic paradigm.